Lending Platform

Our Portfolio Management Software

One click. Real insights. Better decisions.

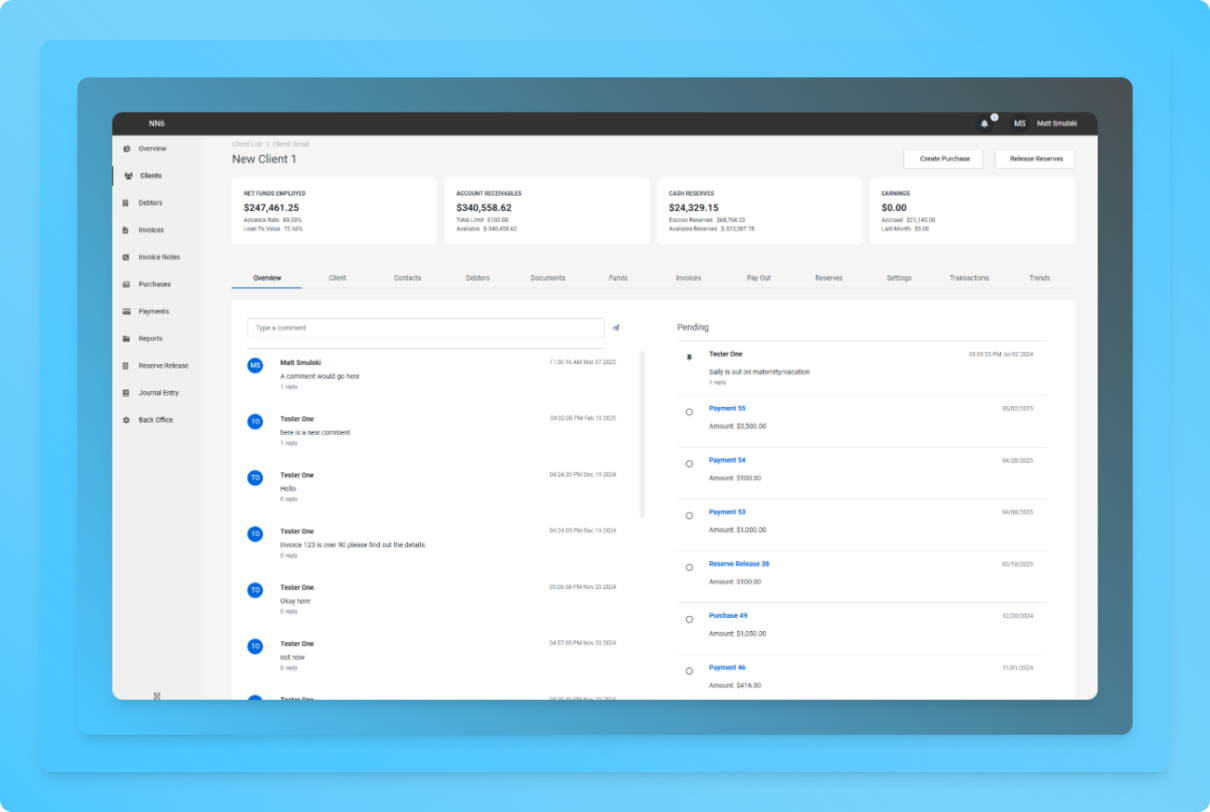

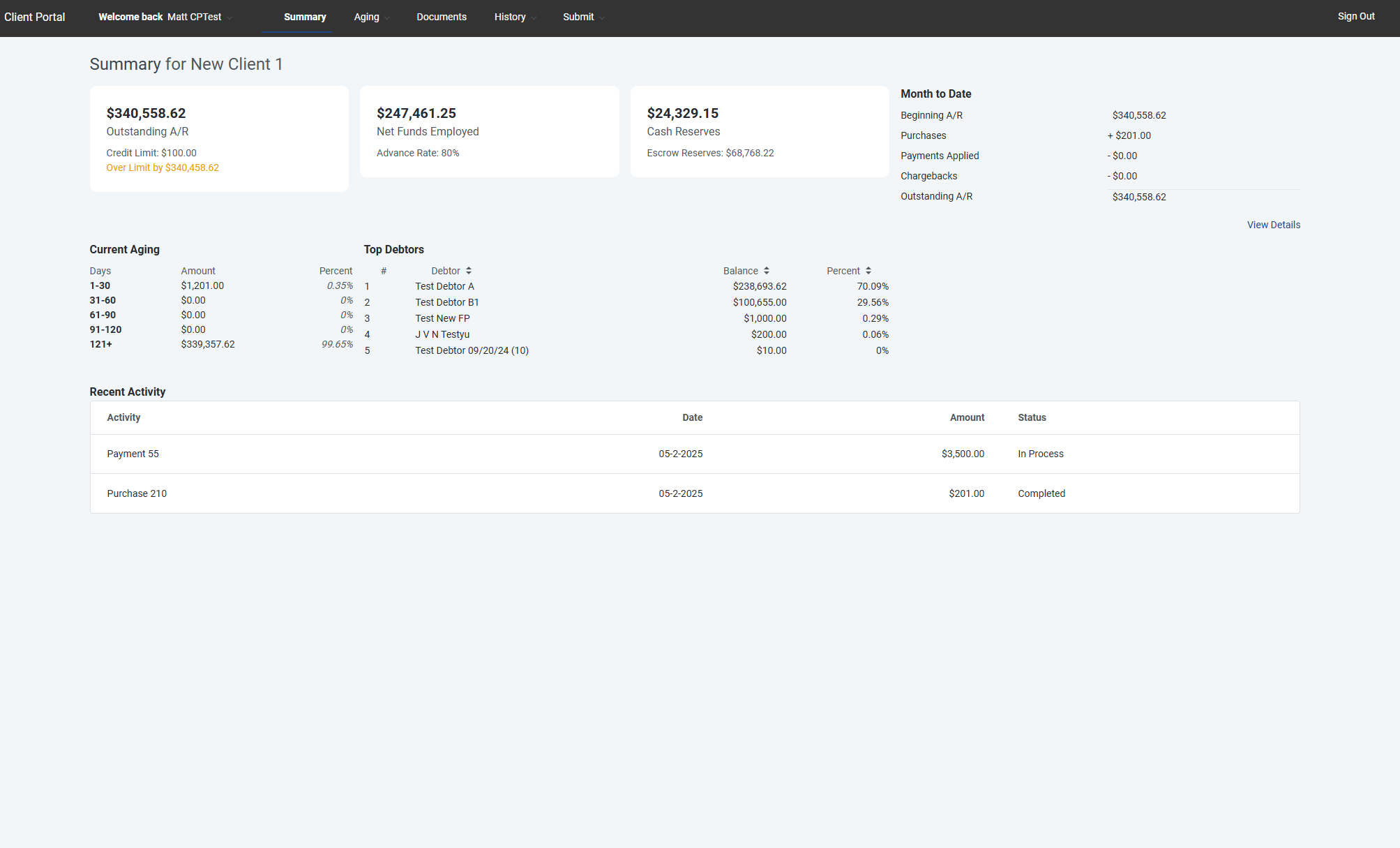

Streamlined Client Communication

Our Client Portal is designed to remove friction from your daily operations. This centralized hub allows your clients to monitor their account, submit new invoice batches for funding, request reserve releases. With integrated document sharing, you can securely share documents with your client for total transparency.

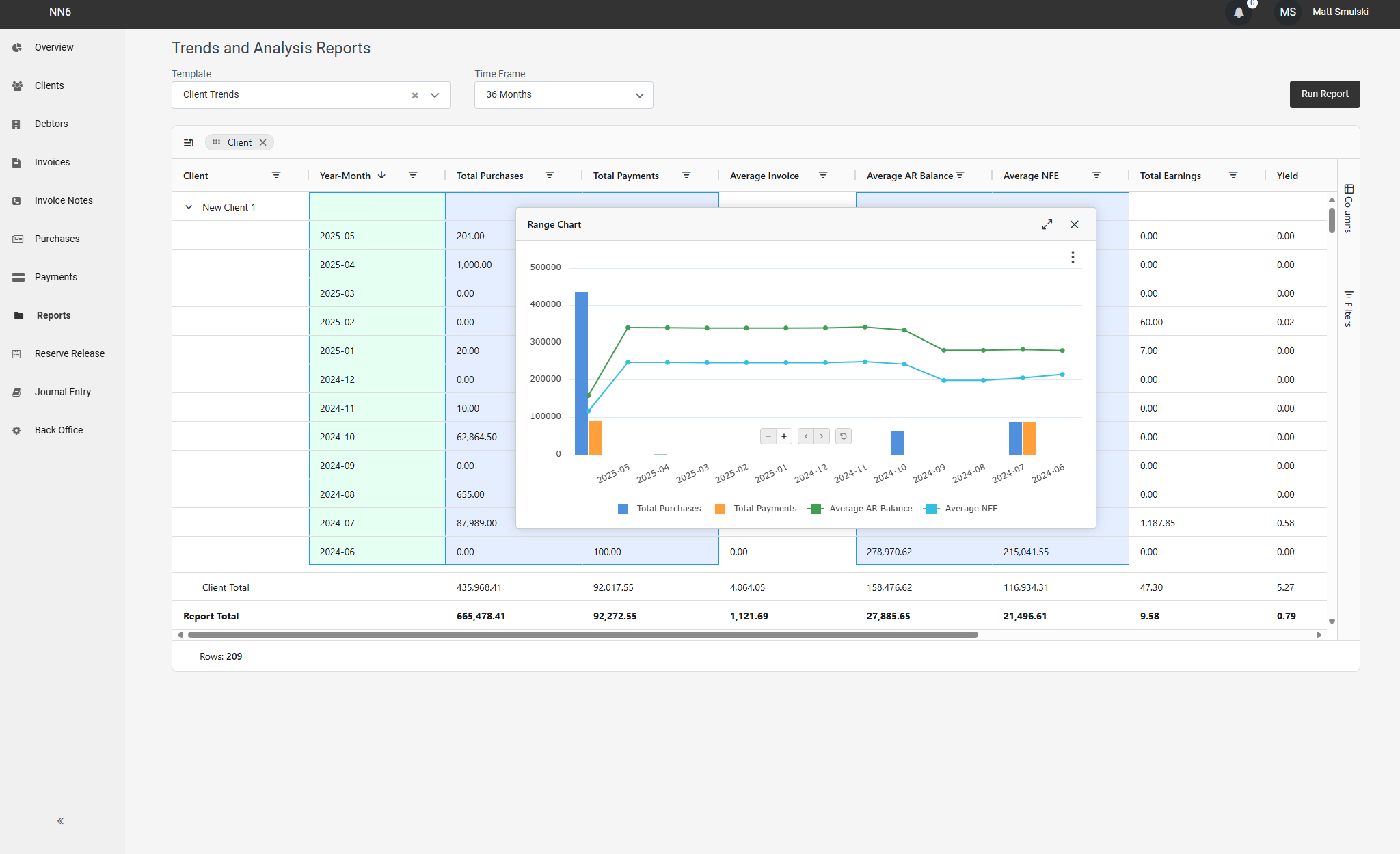

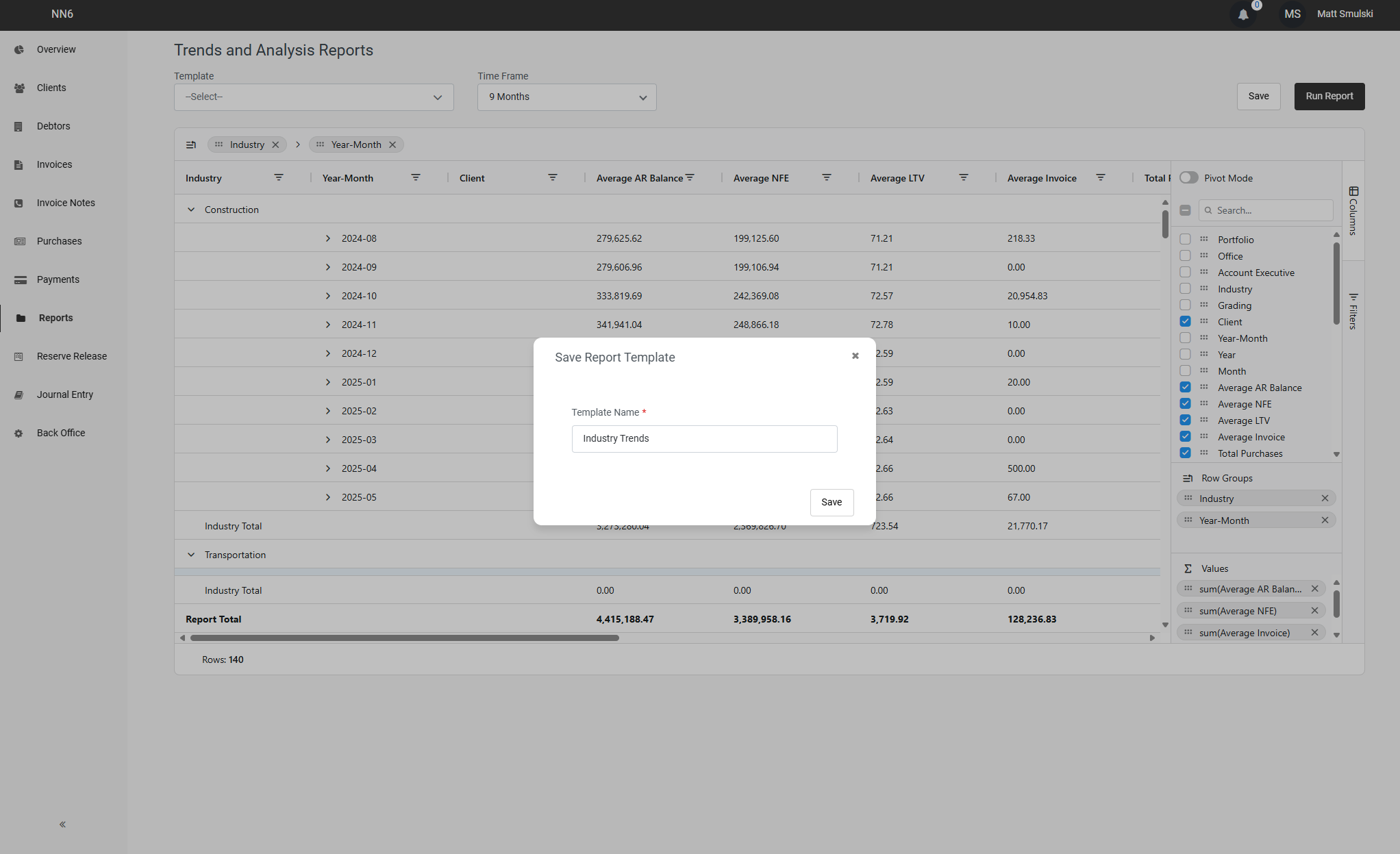

Bespoke Reporting & Visual Dashboards

Get the answers you need, exactly how you want to see them. Our reporting tool offers total flexibility to customize, calculate, and visualize your business metrics. Whether you need a granular list sorted by risk or a high-level visual chart for a portfolio meeting, our integrated system builds the right view in seconds.

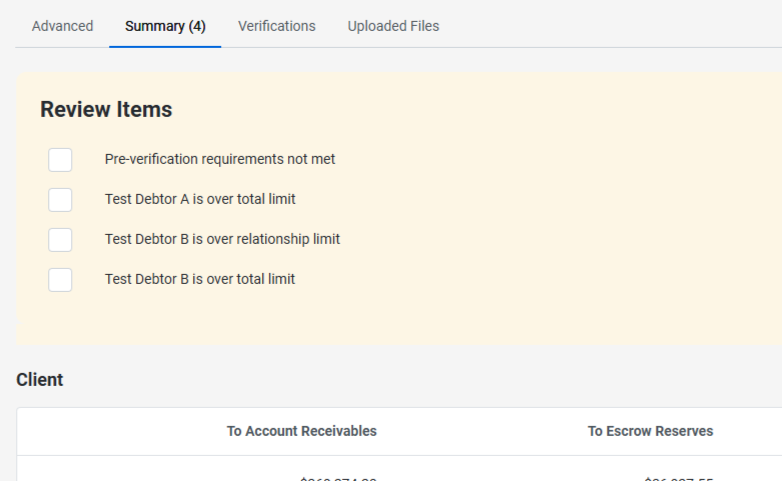

Smart Pre-Funding Checklist

Invoice purchases that contain real-time risk scores/analytics and management approval processes PRE-FUNDING when risks or anomalies have been identified.

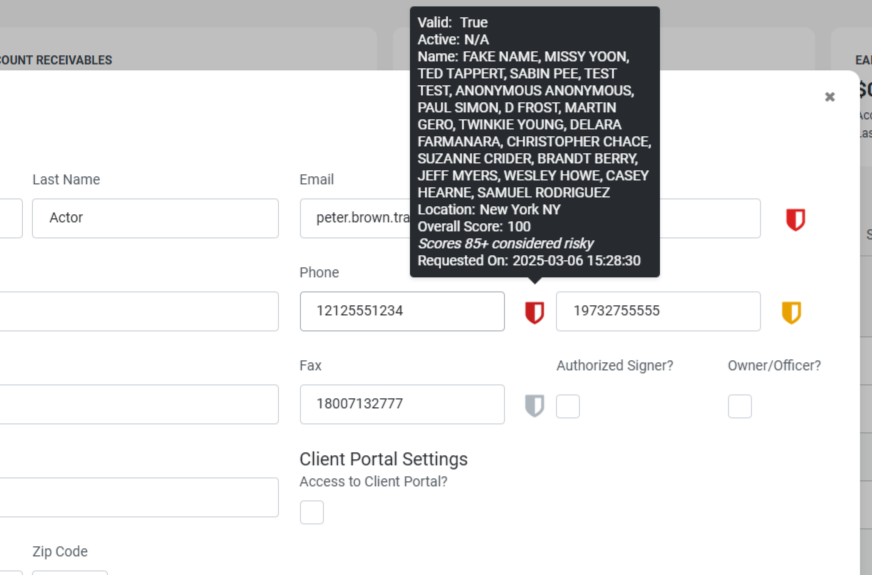

Verify Before You Connect

Stop fraud at the source. Our platform can perform a multi-point security check when you create contacts, ensuring you have the full picture before making the first call.

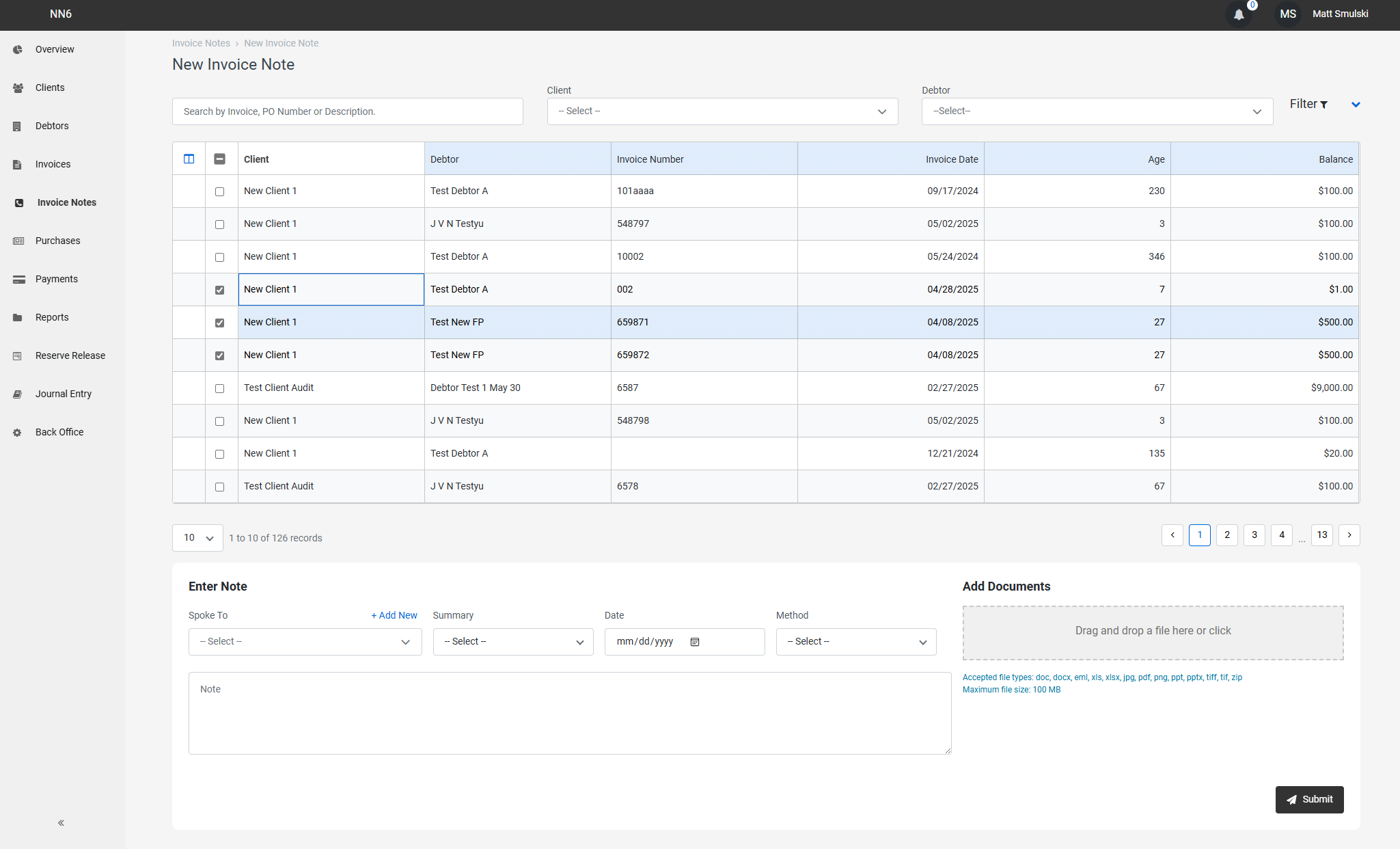

Unified Communication & Note Management

Streamline your collections workflow with a centralized entry point for call logs or activity notes. Apply detailed notes across multiple invoices, clients, or debtors simultaneously, eliminating repetitive data entry. Enhance every record by attaching supporting documentation—such as email threads, screenshots or recording —directly to the note for a comprehensive audit trail.

Personalized Reports

Stop starting from scratch. After customizing your columns, filters, and calculations, save your configuration as a reusable template. Build your perfect report once and access it instantly whenever you need it, ensuring consistent data presentation across your entire team with just one click.

Frequently Asked Questions-

Yes. NN6 is a comprehensive, end-to-end factoring management platform. It is designed to empower lenders by centralizing client management, invoice processing, and risk mitigation within a single environment.

-

Immediately. Once the agreement is signed, our onboarding team begins your environment setup right away. Because our platform is cloud-based, you can be logged in and enjoying the platform same day.

-

Yes. We provide streamlined import tools for core data such as Clients, Debtors, and established relationships via Excel templates. For more complex historical data or full ledger migrations, our technical team can perform a data audit to review requirements for a clean and accurate transition.

-

Absolutely. We believe in showing, not just telling. Contact us to schedule a live walkthrough tailored to your specific workflow. Following the demo, we can provide sandbox access so you can explore the interface firsthand.

-

Our pricing is designed to grow with you through a tiered user-based system. Whether you are a solo factor, a team of 5, or a large shop of 25+, you simply select the "bucket" that matches your current size. This ensures you only pay for the capacity you actually need.